E-Com ETN files for financial reconciliation

Learn about the financial reconciliation file and format.

A Single Transaction Report or the Einzeltransaktionsnachweis (ETN) file is an attachment to the invoice (PDF file). On the second page of the invoice there is a link to download this attachment (CSV file). The ETN contains a detailed cost breakdown of all the transactions processed and billed in the agreed billing period.

You can download the sample file here:

The main characteristics of the fully extended ETN format of E-Com invoices are the following:

The ETN file (CSV) is based on a single, unified format, now covering and supporting all relevant payment methods.

It includes additional fields, which might be filled with merchant-specific data if provided (for example,

TRANSACTION_IDorUSAGE).For every processing card payment transaction, one transaction can now be displayed in two rows. One row for the processing transaction itself and one row for the additional reconciliation data. There are some field inputs specific for each of the rows, for example,

CHANNEL_IDis specific for the processing transactions because it is an Unzer-internal processing specific value.CARD_ORIGINis specific for the reconciliation data because it is a value that is not available during processing but provided later.

Still, a transaction can be identified based on any given unique data, such as the

SHORT_ID.

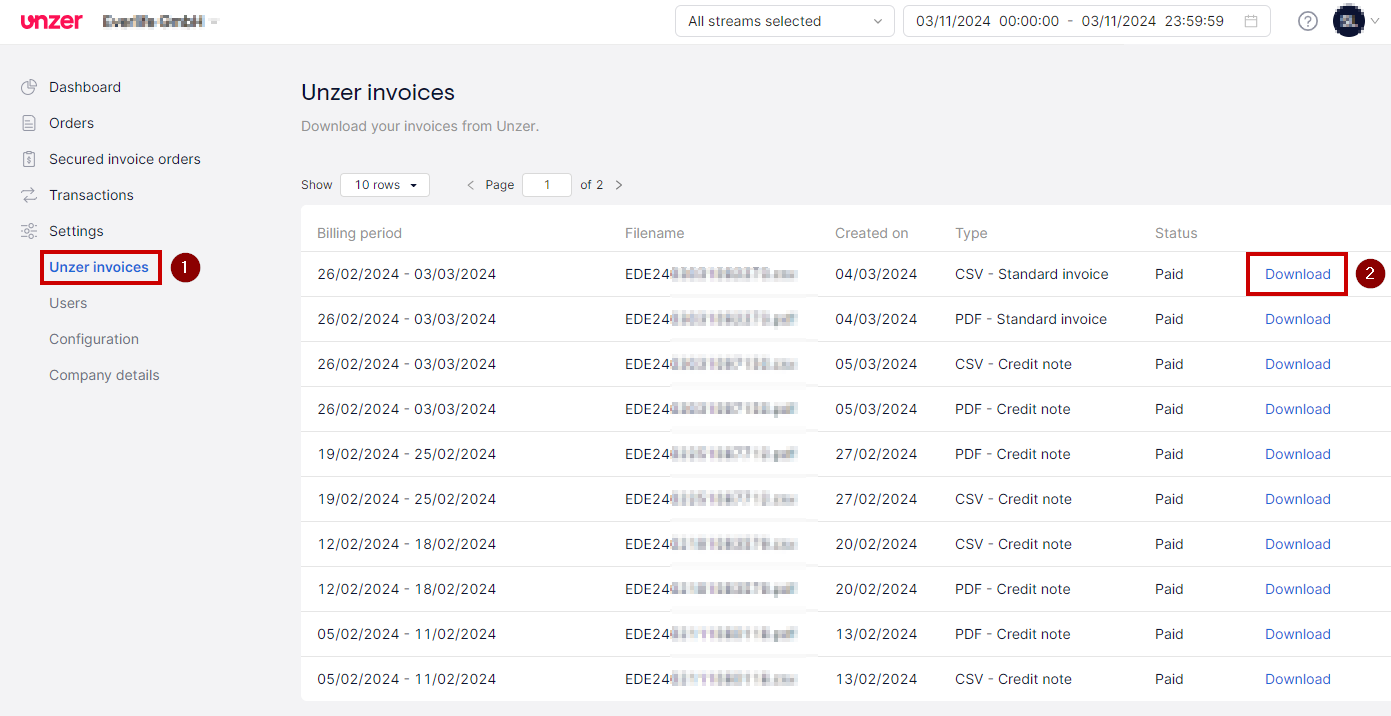

View reconciliation details in Unzer Insights

- To download the file, log in to Unzer Insights and select Invoices.

- Select Download.

The file is downloaded to your preferred location.

View reconciliation details using Unzer Insights API

Exports using Unzer APIs

Unzer Insights provides an API to fetch your available scheduled and order exports that you have configured or created in your account. The API works according to HTTP and JSON standards. You can only access the API with an account that has the user role Admin 1 or Admin 2.

Generate a token

Get a valid token by sending a POST request to the /auth.token endpoint:

POST https://insights.unzer.com/api/auth.token?

{"email,":john.doe@company.com,

"pwd": ei298hnf23fij09u4i234tf243

}

{

"ok": true,

"token": "fe78e9fh9238hf96f089w0eed2"

}

The request body must contain the following parameters:

| Parameter | Type | Description | Example |

|---|---|---|---|

| email (required) | String | The email address of the admin account | john.doe@company.com |

| pwd (required) | String | The MD5 hash from email address plus password without separators | ei298hnf23fij09u4i234tf243 |

Similarly, if you fetch a new token using the API, the valid token in the application expires and the account is automatically logged out.

List of available files

You can retrieve the list of all the available files for the last 14 days by sending a POST request to the /filetransfer.list endpoint:

POST https://insights.unzer.com/api/filetransfer.list?

The request body must contain the following parameters:

| Parameter | Type | Description |

|---|---|---|

| token (required) | String | Valid authentication token |

| page | String | Integer Requested page. The response of the list is limited to 25 elements per page. |

| skip | String | Specify the pages that can be skipped. |

| limit | String | Specify the number of page limit for the report. |

The request body must contain the following parameters:

POST https://insights.unzer.com/api/invoiceFiles.list?

{

"token": "fe78e9fh9238hf96f089w0eed2",

"page": "1",

}

{

"ok": true,

"limit": 20,

"skip": 0,

"total": 20,

"data": [

{

"id_invoice_document": 4240,

"invoice_number": "ELU2307011019325",

"merchant_id": 3538,

"merchant_name": "QaApprove_1674032632-551",

"file_name": "ELU2307011019325.csv",

"file_size": 1161,

"file_type": "INVOICE_APPENDIX_CSV",

"billing_period_start": "2023-07-01 00:00:00",

"billing_period_end": "2023-07-01 00:00:00",

"status": "PAID",

"invoice_type": "STANDARD"

},

{

"id_invoice_document": 4267,

"invoice_number": "ELU2307011019325",

"merchant_id": 3538,

"merchant_name": "QaApprove_1674032632-551",

"file_name": "ELU2307011019325.pdf",

"file_size": 66622,

"file_type": "INVOICE_PDF",

"billing_period_start": "2023-07-01 00:00:00",

"billing_period_end": "2023-07-01 00:00:00",

"status": "PAID",

"invoice_type": "STANDARD"

},

...

Download ETN and invoice files

ETN (csv) or pdf file

You can also download a CSV or a PDF file by sending a POST request to the /filetransfer.download endpoint:

POST: https://insights.unzer.com/api/invoiceFiles.download?

The request body must contain the following parameters:

| Parameter | Type | Description | |

|---|---|---|---|

| token (required) | String | Valid authentication token | |

| id_invoice_document (required) | String | Unique ID for the invoice |

POST https://insights.unzer.com/api/filetransfer.download?token=fe78e9fh9238hf96f089w0eed2&id_invoice_document=4240

{

"token": "fe78e9fh9238hf96f089w0eed2",

"id_invocie_document": "4240"

}

A successful response returns a binary file for the specific report that you requested.

"INV_NO";

"INV_DATE";

"TRANSACTION_DATE (UTC)";

"TRANSACTION_TIME(UTC)";

"METHOD";

"BRAND";

"TYPE";

"RESULT";

"RETURNCODE";

"RETURNCODE_DESC";

"MODE";"CARD_TYPE_GROUP";

"TRANSACTION_CARD_CLASSIFICATION";

"CARD_ORIGIN";"CHANNELNAME";"CHANNEL_ID";

"SHORT_ID";

"UNIQUE_ID";

"TRANSACTION_ID";

"SHOPPER_ID";"INVOICE_ID";"IBAN";

"BIC";

"USAGE";

"DESCRIPTOR";

"IP_COUNTRY";

"ACCOUNT_NUMBER";"EXPIRY_YEAR";"EXPIRY_MONTH";

"TXN_AMOUNT";"TXN_CURRENCY";

"TXN_EXCHANGE_RATE";

"INVOICE_CURRENCY";

"DEBIT_INVOICE_AMOUNT (Negative if refund/chargeback)";

"TXN_FEE_AMOUNT";

"TXN_FEE_CURRENCY";

"TXN_FEE_EXCHANGE_RATE";

"TXN_FEE_INVOICE_AMOUNT";

"DISAGIO_INVOICE_AMOUNT";

"INTERCHANGE_FEE_AMOUNT";

"INTERCHANGE_FEE_CURRENCY";

"SCHEME_FEE_AMOUNT";

"SCHEME_FEE_CURRENCY";

"SERVICE_FEE_AMOUNT";

"SERVICE_FEE_CURRENCY";

"FEE_INVOICE_AMOUNT";

"TOTAL_FEE_INVOICE_AMOUNT";

"FEE_VAT_AMOUNT"

"ELU2307011019325";

"2023-07-02";"2023-07-01";"12:00:00.000";

"INTERNAL_SERVICES";

"MONTHLY";

"TIMED";

"ACK";;;;

"UNSPECIFIED";;

"DOMESTIC";;

"f73daf682ba74c88ab308798e911c207";;

"INTERNAL_SERVICES";;;;;;;;;;;;"0,0000";

"EUR";"1,0000";

"EUR";"0,0000";

"22,5000";

"EUR";"1,0000";"22,5000";"0,0000";"";"";"";"";"";"";"22,5000";

"26,1000";

"3,6000"

List of ETN file parameters and description

| Parameter | Type (length) | Description |

|---|---|---|

| INV_NO | string(256) | Specifies the invoice number this ETN file belongs to. You can find this as a reference to our payout in your bank account statement. |

| INV_DATE | float | Specifies the date of the invoice this ETN file belongs to. |

| TRANSACTION_DATE (UTC) | float | Specifies the timestamp of the processed transaction. Format dd.mm.yyyy (for example, 31.12.2022) |

| TRANSACTION_TIME (UTC) | float | Specifies the timestamp of the processed transaction Format hh:mm:ss.mmm (for example, 10:25:26.000) |

| METHOD | string (256) | Specifies the payment method used for the transaction, for example, card. |

| BRAND | string (256) | Specifies the brand of a method, for example, visaValues are:amexbancontactcartasicartebancairecartebleuecupdankortdinersdiscovereuro6000girocardjcbmaestromastercardpostepayserviredvisavisa_debitvisa_electronvpayundefinedunknown |

| TYPE | string (256) | Specifies the transaction type, for example debit or reversal.Values areauthorizationcapturechange_schedulechargebackchargeback_notificationchargeback_reversalcreditdcc_inquirydebitdebit_reversalderegistrationend_schedulefinalizeinitializenotificationreceiptrefundregistrationreversalscheduletaxfree_inquirythree_ds_authenticationupdate_registrationconfirmationdiagnosiscutoverfile_transferrisk_checkreauthorizationinstallment_inquiryundefinedunknown |

| RESULT | string (256) | Specifies the transaction result, for example, success. Valid values are:successwaitingrejectedfailedunknown |

| RETURNCODE | string (256) | Specifies the transaction return code (Unzer internal). |

| RETURNCODE_DESC | string (256) | Specifies the description for the return code (Unzer internal) |

| MODE | string (20) | Specifies if the transaction was LIVE or TEST transaction |

| CARD_TYPE_GROUP | string (256) | Relevant for card payments only Distinguishes if the card used is a debit card or credit card. Values areCREDITDEBITUNSPECIFIED |

| TRANSACTION_CARD_CLASSIFICATION | string (256) | Relevant for card payments only Distinguishes whether the card used is a commercial card or a consumer card. Valid values are: CONSUMERCOMMERCIALANY |

| CARD_ORIGIN | string (256) | Relevant for card payments only Specifies the card region like Domestic.Values areDOMESTICINTRA_REGIONINTER_REGIONINTRA_EU_WESTERNINTRA_EU_EASTERNINTRA_EU_EEAUNSPECIFIED |

| CHANNELNAME | string (256) | Specifies the name of the channel used for processing (Unzer internal), for example, onlineshop.de. |

| CHANNEL_ID | string (256) | Specifies the identifier of the channel used for processing (Unzer internal). |

| SHORT_ID | string (16) | Specifies the identifier of the processed transaction (Unzer internal). |

| UNIQUE_ID | string (16) | Specifies the second identifier of the processed transaction (Unzer internal). |

| TRANSACTION_ID | string (256) | Specifies the third identifier of the processed transaction. This is an optional value provided by the merchant. It is equivalent to the payment API (PAPI) input parameter orderId. It is usually used as an E2E-reference for reconciliaton purposes. |

| SHOPPER_ID | string (256) | Specifies the end customer’s order identifier or the shop identifier (if provided by the merchant). This is an optional value provided by the merchant. |

| INVOICE_ID | string (256) | Specifies the end customer’s invoice identifier. This is an optional value provided by the merchant. |

| IBAN | string (34) | Specifies the bank account number of the end customer. |

| BIC | string (15) | Specifies the BIC number of the card used by the end customer |

| USAGE | string (128) | Specifies the usage field of the transaction. This is an optional value provided by the merchant. |

| DESCRIPTOR | string (256) | Specifies the purpose of use by Unzer. |

| IP_COUNTRY | string (64) | Specifies the IP of the device that is used for the transaction. |

| ACCOUNT_NUMBER | string (35) | Relevant for card payments only It is the masked number of the credit card. |

| EXPIRY_YEAR | string (16) | Relevant for card payments only Specifies the expiry year as specified on the card used for the transaction. |

| EXPIRY_MONTH | string (16) | Relevant for card payments only Specifies the expiry month as specified on the card used for the transaction. |

| TXN_AMOUNT | BigDecimal | Specifies the amount of the transaction. |

| TXN_CURRENCY | enum | Specifies the currency of the transaction |

| TXN_EXCHANGE_RATE | BigDecimal | Specifies the applied exchange rate when the payout currency is not equal to the transaction currency. The value is 1 when the transaction and payout currency are the same. |

| INVOICE_CURRENCY | enum | Specifies the payout currency of the invoice the ETN belongs to. |

| DEBIT_INVOICE_AMOUNT | BigDecimal | Specifies the transaction volume applied to this invoice. Amount in decimal values (for example, 50.19), will be negative for refund or chargeback. The amount will be zero for rejected transactions and non-cash flow transactions. |

| TXN_FEE_AMOUNT | BigDecimal | Specifies the fixed fee amount applied to this transaction on this invoice. Amount in decimal values (for example, 1.29). |

| TXN_FEE_CURRENCY | enum | Specifies the base currency for fees and is always EUR. |

| TXN_FEE_EXCHANGE_RATE | BigDecimal | Specifies the exchange rate applied to fee amount. It is only relevant if the payout currency does not equal EUR. |

| TXN_FEE_INVOICE_AMOUNT | BigDecimal | Specifies the fixed fee amount applied to this transactions for the invoice in the payout currency. Amount in decimal values (for example, 1.29) |

| DISAGIO_INVOICE_AMOUNT | BigDecimal | Specifies the disagio fee amount applied to this transaction for the invoice in the payout currency. Amount in decimal values (for example, 1.29) |

| INTERCHANGE_FEE_AMOUNT | BigDecimal | Only relevant for specific pricing models Specifies the fee amount applied to this transaction on this invoice. |

| INTERCHANGE_FEE_CURRENCY | enum | Only relevant for specific pricing models Specifies the currency of the fee. |

| SCHEME_FEE_AMOUNT | BigDecimal | Only relevant for specific pricing models Specifies the fee amount applied to this transaction on this invoice. |

| SCHEME_FEE_CURRENCY | enum | Only relevant for specific pricing models Specifies the currency of the service fee. |

| SERVICE_FEE_AMOUNT | BigDecimal | Only relevant for specific pricing models Specifies the fee amount applied to this transaction on this invoice. |

| SERVICE_FEE_CURRENCY | enum | Only relevant for specific pricing models Specifies the currency of the fee. |

| FEE_INVOICE_AMOUNT | BigDecimal | Specifies the sum of all fees amount in the invoice currency applied to this transaction on this invoice, excluding VAT (fee net amount) Amount in decimal values (for example, 1.00) |

| TOTAL_FEE_INVOICE_AMOUNT | BigDecimal | Specifies the sum (in the invoice currency) of all fees applied to this transaction for this invoice, including VAT (fee gross amount). |

| FEE_VAT_AMOUNT | BigDecimal | Specifies the tax amount (in the invoice currency) applied to the fee net amount. |