Integrate using Hosted Payment Page

Accept payments using a customizable and ready-to-use payment page that is seamlessly integrated into your shop.

Overview

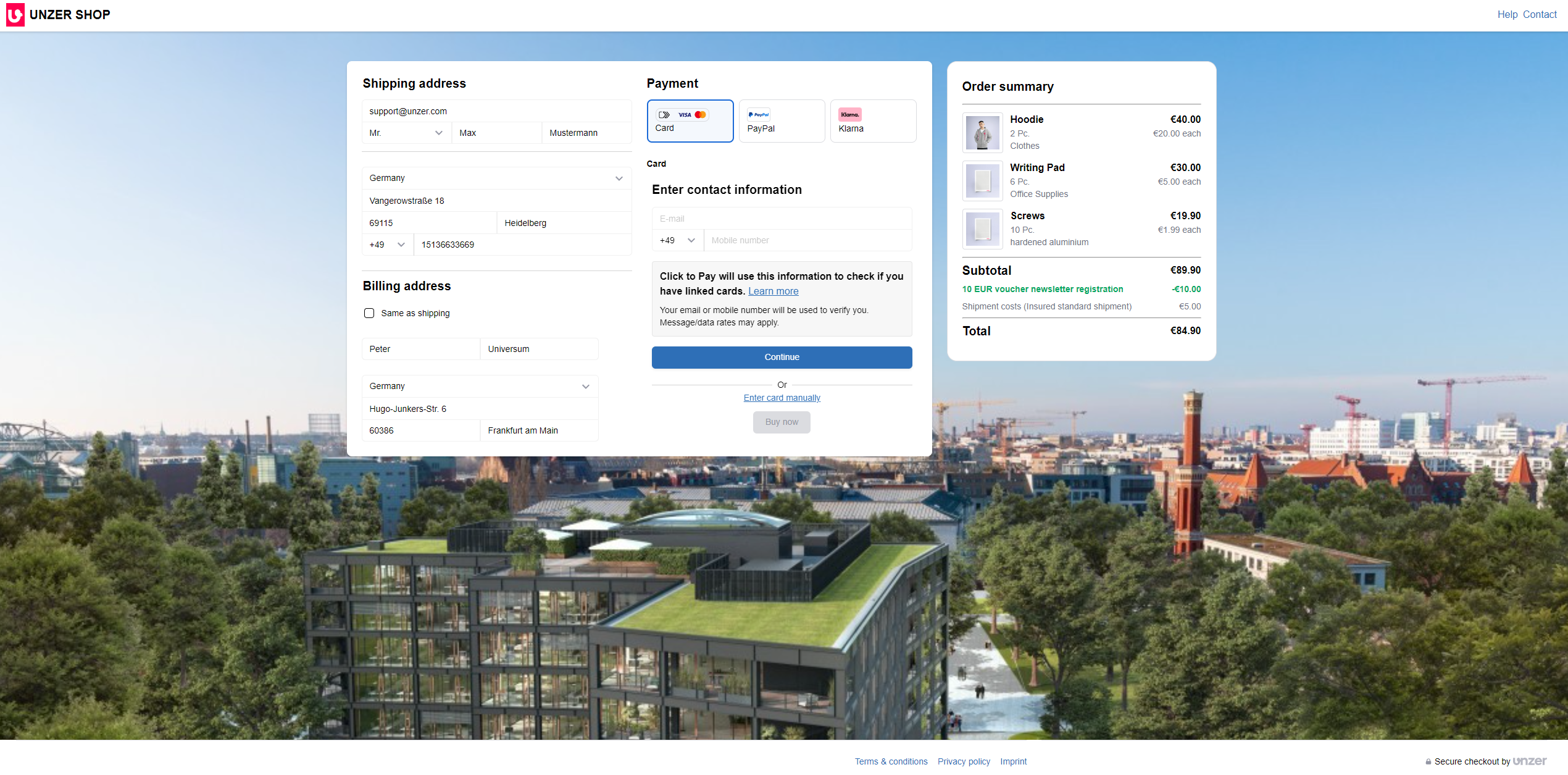

Hosted Payment Page (HPP) is a ready-made Unzer hosted website containing your payment methods mix. When a customer selects the pay-button in your online shop, they are redirected to the Hosted Payment Page. They can then make the payment using their desired option. After the payment is completed they are redirected back to your shop.

Same as with the EPP, using Hosted Payment Page you can support multiple payment methods with one simple integration. The HPP is the easiest way to integrate with Unzer.

You can check the HPP in action on our demo page by selecting Checkout with Payment Page.

The Hosted Payment Page is fully responsive, and its user interface can be customized. You can change the images, colors and text, and hide the basket items from the page.

Read this guide for a general overview on how to accept payments with Hosted Payment Page. For a list of all payment methods supported by HPP, go to the Supported Payment methods page.

Before you begin

Check the basic integration requirements.

How it works

To integrate payments using HPP you need to perform steps both on client and server side.

- First, set up the payment page – create

customerandbasketresources and initialize the payment page on the server side. - Using the information form the previous step, you can now redirect your customer to the Hosted Payment Page where the payment is done.

- After the payment, check its status on the server side and display the result to the customer on the client side

- Perform more operations on the server side once the payment has been made, for example, charging the authorized amount.

Step 1: Set up the payment pageserver side

Step 1: Set up the payment page [server side]First, you should prepare resources required when initializing the payment page on the server side – customer (recommended), basket (recommended), and the metadata resource (optional).

Create Customer resource (recommended)

The customer resource contains information about the customer and is required for the payment methods Unzer Invoice, Direct Debit Secured, Unzer Installment, and Klarna payment methods.

We recommend that you always provide the customer resource.

To use an existing customer resource, you just need its corresponding customerId. If you don’t have an existing customer resource, you can create it on the server side.

POST https://api.unzer.com/v1/customers

{

"lastname": "Mustermann",

"firstname": "Max",

"salutation": "mr",

"customerId": "51222",

"birthDate": "1970-01-01",

"email": "info@unzer.com",

"phone": "+49 6221 - 64 71 100",

"mobile": "+49 172 123 456",

"billingAddress": {

"name": "Max Mustermann",

"street": "Schöneberger Str. 21a",

"zip": "10963",

"city": "Berlin",

"country": "DE"

},

"shippingAddress": {

"name": "Max Mustermann",

"street": "Schöneberger Str. 21a",

"zip": "10963",

"city": "Berlin",

"country": "DE"

}

}

$unzer = new Unzer('s-priv-xxxxxxxxxx');

$address = (new Address())

->setName('Max Mustermann')

->setStreet('Schöneberger Str. 21a')

->setZip('10963')

->setCity('Berlin')

->setCountry('DE');

$customer = (new Customer())

->setFirstname('Max')

->setLastname('Mustermann')

->setSalutation(Salutations::MR)

->setCompany('Unzer GmbH')

->setBirthDate('1972-12-24')

->setEmail('Max.Mustermann@unzer.com')

->setMobile('+49 123456789')

->setPhone('+49 123456789')

->setBillingAddress($address)

->setShippingAddress($address);

$unzer->createCustomer($customer);

Address address = new Address();

address

.setName("Max Mustermann")

.setStreet("Schöneberger Str. 21a")

.setCity("Berlin")

.setZip("10963")

.setCountry("DE");

Customer customer = new Customer("Max", "Mustermann");

customer

.setCustomerId(customerId)

.setSalutation(Salutation.mr)

.setEmail("max.mustermann@unzer.com")

.setMobile("+49123456789")

.setBirthDate(getDate("12.12.2000"))

.setBillingAddress(address)

.setShippingAddress(address);

Unzer unzer = new Unzer("s-priv-xxxxxxxxxx");

customer = unzer.createCustomer(customer);

Payment types which require customer resource will not be available if neither customer ID nor customer form is provided (for example, payment page is set to “payment_only”).

For a full description of customer resource, please refer to relevant server-side integration documentation page: Manage customer (direct API calls), Manage customer (PHP SDK), Manage customer (Java SDK).

Create the basket resource (recommended)

The basket resource stores information about the purchased products, used vouchers, and shipment costs. It is required for Unzer Invoice, Unzer Installment, Direct Debit Secured, and Klarna payment methods. We recommend that you always create a basket resource.

POST https://api.unzer.com/v2/baskets

{

"totalValueGross": 190.0,

"currencyCode": "EUR",

"note": "Test Basket",

"orderId": "Order-12345",

"basketItems": [

{

"amountDiscountPerUnitGross": 1.0,

"amountPerUnitGross": 20.0,

"basketItemReferenceId": "Item-d030efbd4963",

"imageUrl": "https://a.storyblok.com/f/91629/x/1ba8deb8cc/unzer_primarylogo__white_rgb.svg",

"quantity": 10,

"subTitle": "This is brand new Mid 2019 version",

"title": "SDM 6 CABLE",

"type": "goods",

"unit": "m",

"vat": 19.0

}

]

}

$unzer = new Unzer('s-priv-xxxxxxxxxx');

$basketItem = (new BasketItem())

->setBasketItemReferenceId('Item-d030efbd4963')

->setQuantity(10)

->setUnit('m')

->setAmountPerUnitGross(20.00)

->setAmountDiscountPerUnitGross(1.00)

->setVat(19.0)

->setTitle('SDM 6 CABLE')

->setSubTitle('This is brand new Mid 2019 version')

->setImageUrl('https://a.storyblok.com/f/91629/x/1ba8deb8cc/unzer_primarylogo__white_rgb.svg')

->setType(BasketItemTypes::GOODS);

$basket = (new Basket())

->setTotalValueGross(190.00)

->setCurrencyCode('EUR')

->setOrderId('Order-12345')

->setNote('Test Basket')

->addBasketItem($basketItem);

$unzer->createBasket($basket);

BasketItem basketItem = new BasketItem()

.setBasketItemReferenceId("Item-d030efbd4963")

.setQuantity(BigDecimal.valueOf(10))

.setUnit("m")

.setAmountPerUnitGross(BigDecimal.valueOf(20.00))

.setAmountDiscountPerUnitGross(BigDecimal.valueOf(1.00))

.setVat(BigDecimal.valueOf(19.0))

.setTitle("SDM 6 CABLE")

.setSubTitle("This is brand new Mid 2019 version")

.setImageUrl(new URL("https://a.storyblok.com/f/91629/x/1ba8deb8cc/unzer_primarylogo__white_rgb.svg"))

.setType(BasketItem.Type.GOODS);

Basket basket = new Basket()

.setTotalValueGross(BigDecimal.valueOf(190.00))

.setCurrencyCode(Currency.getInstance("EUR"))

.setOrderId("Order-12345")

.setNote("Test Basket")

.addBasketItem(basketItem);

Unzer unzer = new Unzer("s-priv-xxxxxxxxxx");

unzer.createBasket(basket);

For a full description of basket resource, please refer to relevant server-side integration documentation page:

Manage basket (direct API calls),

Manage basket (PHP SDK),

Manage basket (Java SDK).

(Optional) Create metadata

Metadata is the additional information you can append to each payment. By adding metadata, you can store important information about the order or the payment. Add the metadata by adding it in the additional resources. To learn more about metadata, go to the Manage metadata page.

Step 2: Initialize the payment pageserver side

Step 2: Set up the payment page [server side]

Now you can combine the resources with the data about the transaction and payment page configuration options to make an initialization call for the payment page. However, before you initialize the Payment Page, you need to issue a new bearer token for authentication against the Payment Page API.

Issue a new bearer token for authentication

Payment Page v2 Common Features [server side]As long as a token is valid, it can be used multiple times for calls to Payment Page API.

To keep the token authentication mechanism safe and secure, there are some measures that need to be taken into account:

- A requested token is valid for 7 minutes‚ after which it expires, and you need to request a new one.

- There is a rate limit in place that allows 2 token creations per second.

Unzer instance.Authorization: Basic auth with your merchant private key.

GET https://token.upcgw.com/v1/auth/token

{

"accessToken": "eyJraWQiOiJhbGlhcy9jb25uZWN0aXZpdHktdjItdG9rZW4ta21zIiwiYWxnIjoiUlMyNTY..."

}

To learn more, go to the Authentication page.

Initialize a new Payment Page

You can initialize the payment page to support either charge or authorize transactions. For a more detailed description of charge and authorize transactions, please refer to relevant server-side integration documentation page: Manage API resources (direct API calls), Manage API resources (PHP SDK), Manage API resources (Java SDK).

Some payment methods support Two-step payments (both authorize and charge) transactions. For these payment methods, you can choose the transaction type during the payment page creation.

However, some payment methods only support One-step payments (charge). In such a case if the payment page is called with type authorize (Two-step flow), the One-Step payment methods will be displayed as well. A charge will be automatically executed for the One-Step only payment methods if one of these is selected for payment.

To learn more about which payment methods support One-step or Two-step flows, go to Support payment methods.

Now you can combine the resources with the data about the transaction (for example, amount, currency) and payment page configuration options (such as return URL, shop name & logo) to make an initialization call for the payment page.

You need to save the paypageId and redirectURL contained in paypage call response. The redirectUrl is a unique Hosted Payment Page URL, where the customer completes the payment and the paypageId is required to check the payment later.

To create a Hosted Payment Page, in the create payment page request, set the type flag to hosted.

https://paypage.unzer.com/v2/merchant/paypage

{

"mode": "authorize",

"shopName": "UNZER SHOP",

"amount": "84.9000",

"currency": "EUR",

"type": "hosted", // hosted, embedded , linkpay

"checkoutType": "full",

//full: The entire customer data is displayed on the payment page and can be edited.

//payment_only: Customer data is not displayed and cannot be edited.

//no_shipping: Customer data is displayed, but the shipping address is read-only.

//"recurrenceType": "scheduled" // unscheduled

"orderId": "Order12",

"invoiceId": "InvoiceID34",

"paymentReference": "Payment Online Shop",

"urls": {

"termsAndCondition": "https://www.unzer.com",

"privacyPolicy": "https://www.unzer.com",

"imprint": "https://www.unzer.com",

"help": "https://www.unzer.com",

"contact": "https://www.unzer.com"

"returnSuccess": "https://www.unzer.com",

"returnPending": "https://www.unzer.com",

"returnFailure": "https://www.unzer.com",

"returnCancel": "https://www.unzer.com"

},

//There is a difference beetween customization styles options for the types "embedded", "hosted" and "linkpay".

//the type "hosted" is the type who is able to consume all of the customization styles.

"style": {

"logoImage": "https://www.mydomain.de/img/logo_rb_uzr.png",

"backgroundColor": "#CCC",

"footerColor": "#FFFFFF",

"headerColor": "#FFFFFF",

"linkColor": "#2E6FB7",

"textColor": "#000",

"brandColor": "#2E6FB7",

"cornerRadius": "1",

"hideUnzerLogo": "false",

"backgroundImage": "https://www.mydomain.de/img/logo3.png",

"font": "Arial",

"shadows": "true",

"favicon": "https://www.mydomain.de/img/logo_rb_uzr.png"

},

"paymentMethodsConfigs": {

"default": {

"enabled": false

},

"cards": {

"enabled": true,

"order": 1

},

"paypal": {

"enabled": true,

"order": 2

},

"klarna": {

"enabled": true,

"order": 3

},

"eps": {

"enabled": false,

"order": 0

}

},

"customerSettings": {

"type": "B2C",

"allowedCountries": [

"DE"

]

},

"resources": {

"customerId": "{{customerId}}",

"basketId": "{{basketId}}"

}

}

$unzer = new Unzer('s-priv-xxxxxxxxxx');

$paypage = new Paypage(9.99, 'EUR'); // charge as default type.

//or if authorize is preferred:

//$paypage = new Paypage(9.99, 'EUR', 'authorize');

//it is recommended to add a customer object.

$customer = $unzer->createCustomer(CustomerFactory::createCustomer('Max', 'Mustermann'));

$resources = new Resources($customer->getId(), null, null);

//optionally add a none default config for card payment

$cardConfig = (new PaymentMethodConfig(true, 1))

->setCredentialOnFile(true)

->setExemption(ExemptionType::LOW_VALUE_PAYMENT);

$methodConfigs = (new PaymentMethodsConfigs())->addMethodConfig(Card::class, $cardConfig)

$paypage->setLogoImage('http://www.any.ed/images/page/info-img.png')

->setOrderId('shop-order-id')

->setShopName('Any shop name')

->setInvoiceId('shop-invoice-id')

->setPaymentMethodconfigs($methodConfigs)

->setResources($resources);

$unzer->createPaypage($paypage);

// Redirect to the paypage

redirect($paypage->getRedirectUrl());

Unzer unzer = new Unzer("s-priv-xxxxxxxxxx");

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

//or if authorize is preferred:

//PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR", "authorize");

//it is recommended to add a customer object.

Customer customer = unzer.createCustomer(new Customer("Max", "Mustermann"));

Resources resources = new Resources(customer.getId(), null, null);

//optionally add a none default config for card payment

PaymentMethodConfig cardConfig = (new PaymentMethodConfig(true, 1))

.setCredentialOnFile(true)

.setExemption(CardTransactionData.ExemptionType.LVP.toString().toLowerCase());

HashMap<String, PaymentMethodConfig> methodConfigs = new HashMap<>()

methodConfigs.put("cards", cardConfig);

paypage.setLogoImage("http://www.any.ed/images/page/info-img.png")

.setOrderId("shop-order-id")

.setShopName("Any shop name")

.setInvoiceId("shop-invoice-id")

.setPaymentMethodsConfigs(methodConfigs)

.setResources(resources);

PaypageV2 response = unzer.createPaypage(paypage);

// Redirect to the paypage

String redirectUrl = paypage.getRedirectUrl();

The response looks similar to the following example:

{

"paypageId": "01927c33-871f-73fa-9e68-22577cc4c369-b4818aba-d4a2-4193-818a-bad4a2e19352",

"redirectUrl": "https://static.int.unzer.com/v2/paypage/#/01927c33-871f-73fa-9e68-22577cc4c369-b4818aba-d4a2-4193-818a-bad4a2e19352?publicKey=cy1wdWItMmExMGFlQU1Xd0VNSGx0SEpqUW8zMmowRk5UakJNWkQ=",

"qrCodeSvg": null

}

For a complete list of parameters, see the Payment Page Reference.

Payment Page v2 Common Features [server side]Optional: Common features

Recurring payments

To create a Payment Page for recurring payments, you need to provide the recurrenceType flag in the create Payment Page call.

recurrenceType flag is optional and only needed if you want to create a Payment Page with recurring payments.The following recurrence types are supported by our payment pages: unscheduled and scheduled.

The recurrence type oneclick is automatically set whenever a previously stored One-click payment type is used or the customer enables the checkbox to store the payment type for future payments.

scheduled and unscheduled are only supported for the card payment method. This means that the list of payment methods will be reduced to this payment method and the other payment methods will be hidden.For more information, go to the recurring payments page.

{

"mode": "authorize",

"amount": "84.9000",

"currency": "EUR",

"recurrenceType": "scheduled",

"resources": {

"customerId": "{{customerId}}",

"basketId": "{{basketId}}"

}

}

$paypage = new Paypage(9.99, 'EUR', 'charge');

$paypage->setRecurrenceType("scheduled");

$unzer->createPaypage($paypage);

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

paypage.setRecurrenceType("scheduled");

PaypageV2 response = unzer.createPaypage(paypage);

Select a checkout type

Payment pages support different checkout types. The following checkout types are supported:

full: Customer-related data, like billing and shipping address, are required and corresponding form fields are rendered. If acustomerIdis set in the initial request, the forms will be preloaded.payment_only: Customer-related forms are not rendered.no_shipping: Only the billing address form are rendered. This is useful for digital goods or services.

If you create a payment page with disabled customer form, keep in mind that some payment methods require a customer object.

In these cases, the customerId needs to be provided in the create payment page call, otherwise those payment methods will not be available.

{

"mode": "authorize",

"amount": "84.9000",

"currency": "EUR",

"checkoutType": "payment_only",

"resources": {

"customerId": "{{customerId}}",

"basketId": "{{basketId}}"

}

}

$paypage = new Paypage(9.99, 'EUR', 'charge');

$paypage->setCheckoutType("payment_only");

$unzer->createPaypage($paypage);

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

paypage.setCheckoutType("payment_only");

PaypageV2 response = unzer.createPaypage(paypage);

Create a payment page with custom return URLs

returnURL is only required for LinkPay and Hosted Payment Page.To redirect the end customer to the correct result URL in your system, you can set the following URLs.

If no URL is set, the payment page will render default result pages instead.

{

...

"urls": {

"returnSuccess": "https://example.com/success",

"returnPending": "https://example.com/pending",

"returnFailure": "https://example.com/failure",

"returnCancel": "https://example.com/cancel"

}

...

}

$urls = new Urls();

$urls->setReturnSuccess('https://returnsuccess.com');

$urls->setReturnPending('https://returnpending.com');

$urls->setReturnFailure('https://returnfailure.com');

$urls->setReturnCancel('https://returncancel.com');

$paypage = new Paypage(9.99, 'EUR', 'charge');

$paypage->setUrls($urls);

$unzer->createPaypage($paypage);

Urls urls = new Urls()

.setReturnSuccess("https://returnsuccess.com")

.setReturnPending("https://returnpending.com")

.setReturnFailure("https://returnfailure.com")

.setReturnCancel("https://returncancel.com");

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

paypage.setUrls(urls);

PaypageV2 response = unzer.createPaypage(paypage);

Create a payment page with custom links

To redirect the end customer to the correct informational pages of your shop, such as imprint, contact, help, you can set the corresponding URLs in the urls section of the request body.

{

...

"urls": {

"termsAndCondition": "https://example.com",

"privacyPolicy": "https://example.com",

"imprint": "https://example.com",

"help": "https://example.com",

"contact": "https://example.com"

},

...

}

$urls = new Urls();

$urls->setTermsAndCondition('https://termsandcondition.com');

$urls->setPrivacyPolicy('https://privacypolicy.com');

$urls->setImprint('https://imprint.com');

$urls->setHelp('https://help.com');

$urls->setContact('https://contact.com');

$paypage = new Paypage(9.99, 'EUR', 'charge');

$paypage->setUrls($urls);

$unzer->createPaypage($paypage);

Urls urls = new Urls()

.setTermsAndCondition("https://termsandcondition.com")

.setPrivacyPolicy("https://privacypolicy.com")

.setImprint("https://imprint.com")

.setHelp("https://help.com")

.setContact("https://contact.com");

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

paypage.setUrls(urls);

PaypageV2 response = unzer.createPaypage(paypage);

Exclude payment methods

You can configure payment methods so that a subset of the available payment methods is displayed and is available during checkout.

You can enable single payment methods by setting the specific payment method related enabled flag to true.

If you want to enable each payment method individually, then disable all of them by setting the default.enabled flag to false and then set the enabled flag to true only for the payment methods that you want to offer in the checkout.

You can also define the order in which you want to display the various payment methods by setting the order value for each of them. Start the sort order with 0 for the first payment method that should be listed in the checkout.

{

"mode": "charge",

"amount": "84.9000",

"currency": "EUR",

"paymentMethodsConfigs": {

"default": {

"enabled": true

},

"cards": {

"enabled": true,

"credentialOnFile": true,

"order": 0,

"exemption": "lvp"

},

"paypal": {

"enabled": true,

"order": 0,

"credentialOnFile": true

},

"paylaterInstallment": {

"enabled": true,

"order": 0

},

"googlepay": {

"enabled": true,

"order": 0

},

"applepay": {

"enabled": true,

"order": 0

},

"klarna": {

"enabled": true,

"order": 0

},

"sepaDirectDebit": {

"enabled": true,

"order": 0,

"credentialOnFile": true

},

"eps": {

"enabled": true,

"order": 0

},

"paylaterInvoice": {

"enabled": true,

"label": "wHPaLKrOZz4J",

"order": 0

},

"paylaterDirectDebit": {

"enabled": true,

"label": "0hrEFbq 20KwrW",

"order": 0

},

"prepayment": {

"enabled": true,

"order": 0

},

"payu": {

"enabled": true,

"order": 0

},

"ideal": {

"enabled": true,

"order": 0

},

"przelewy24": {

"enabled": true,

"order": 0

},

"alipay": {

"enabled": true,

"order": 0

},

"wechatpay": {

"enabled": true,

"order": 0

},

"bancontact": {

"enabled": true,

"order": 0

},

"pfcard": {

"enabled": true,

"order": 0

},

"pfefinance": {

"enabled": true,

"order": 0

},

"twint": {

"enabled": true,

"order": 0

},

"openbankingpis": {

"enabled": true,

"order": 0

}

},

"resources": {

"customerId": "{{customerId}}",

"basketId": "{{basketId}}"

}

}

$enabledConfig = new PaymentMethodConfig(true, 1);

$paylaterConfig = (new PaymentMethodConfig(true, 1))

->setLabel('Paylater');

$cardConfig = (new PaymentMethodConfig(true, 1))

->setCredentialOnFile(true)

->setExemption(ExemptionType::LOW_VALUE_PAYMENT);

$configs = (new PaymentMethodsConfigs())->setPreselectedMethod('cards')

->setDefault((new PaymentMethodConfig())->setEnabled(false)) //enable or disable all payment methods by default

->addMethodConfig(Card::class, $cardConfig)

->addMethodConfig(PaylaterInstallment::class, $enabledConfig)

->addMethodConfig(Googlepay::class, $enabledConfig)

->addMethodConfig(Applepay::class, $enabledConfig)

->addMethodConfig(PaylaterInvoice::class, $paylaterConfig);

$paypage = new Paypage(9.99, 'EUR', 'charge');

$paypage->setPaymentMethodsConfigs($configs);

$unzer->createPaypage($paypage);

PaymentMethodConfig enabledConfig = (new PaymentMethodConfig(true, 1));

PaymentMethodConfig paylaterConfig = (new PaymentMethodConfig(true, 1))

.setLabel("Paylater");

PaymentMethodConfig cardConfig = (new PaymentMethodConfig(true, 1))

.setCredentialOnFile(true)

.setExemption(CardTransactionData.ExemptionType.LVP.toString().toLowerCase());

HashMap<String, PaymentMethodConfig> methodConfigs = new HashMap<>();

methodConfigs.put("default", new PaymentMethodConfig(false));

methodConfigs.put("cards", cardConfig);

methodConfigs.put("paylaterInstallment", enabledConfig);

methodConfigs.put("googlepay", enabledConfig);

methodConfigs.put("applepay", enabledConfig);

methodConfigs.put("paylaterInvoice", paylaterConfig);

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

paypage.setPaymentMethodsConfigs(methodConfigs);

PaypageV2 response = unzer.createPaypage(paypage);

Risk settings

The following risk related settings can be passed and may increase the acceptance rate.

| Parameter | Type | Description | Example values |

|---|---|---|---|

risk.customerGroup | string | Customer classification for the customer if known. Valid values: TOP: Customers with more than 3 paid transactions GOOD: Customers with more than 1 paid transactions BAD: Customers with defaulted/fraudulent orders NEUTRAL: Customers without paid transactions | "GOOD" |

risk.confirmedAmount | int | The amount/value of the successful transactions paid by the end customer | Positive number: 891 |

risk.confirmedOrders | int | The number of successful transactions paid by the end customer | Positive number: 10 |

risk.registrationLevel | string | Customer registration level 0=guest, 1=registered | "0" |

risk.registrationDate | string | Customer registration date in your shop (YYYYMMDD) | "2019-01-01" |

{

"mode": "authorize",

"amount": "84.9000",

"currency": "EUR",

"risk": {

"registrationLevel": "string",

"registrationDate": "string",

"customerGroup": "top",

"confirmedOrders": 0,

"confirmedAmount": 0

},

"resources": {

"customerId": "{{customerId}}",

"basketId": "{{basketId}}"

}

}

$risk = new RiskData();

$risk->setCustomerGroup('TOP')

->setConfirmedAmount(1234)

->setConfirmedOrders(42)

->setRegistrationLevel('1')

->setRegistrationDate('20160412');

$paypage = new Paypage(9.99, 'EUR', 'charge');

$paypage->setRisk($risk);

$unzer->createPaypage($paypage);

RiskData risk = new RiskData();

risk.setCustomerGroup("TOP")

.setConfirmedAmount(1234)

.setConfirmedOrders(42)

.setRegistrationLevel("1")

.setRegistrationDate("20160412");

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

paypage.setRisk(risk);

PaypageV2 response = unzer.createPaypage(paypage);

Credentials on file (COF)

You can enable storing payment methods on your payment page to make it easier for returning customers to pay. This feature is called Credentials on File (COF) and is supported by the following payment methods:

- card

- sepa-direct-debit

- paypal

By default, this feature is enabled for all the supported payment methods listed above.

In case you want to disable it, you can use the flag credentialOnFile in the corresponding payment method within paymentMethodsConfigs or disable it for all and enable it for individual payment methods.

For the latter case the property paymentMethodConfigs.default.credentialOnFile must be set false.

- COF payments in combination with cards automatically triggers a One-click payment.

- Because the payment methods related to the customer are presented in the frontend, this feature requires the

customerIdto be set, or the customer form to be present.

{

"mode": "authorize",

"amount": "84.9000",

"currency": "EUR",

"paymentMethodsConfigs": {

"default": {

"credentialOnFile": false

},

"card": {

"credentialOnFile": true

}

},

"resources": {

"customerId": "p-cst-1234"

}

}

$paypage = new Paypage(9.99, 'EUR', 'charge');

$cofDisabledConfig = (new PaymentMethodConfig())->setCredentialOnFile(false);

$config = (new PaymentMethodsConfigs())

->addMethodConfig(Card::class, $cofDisabledConfig)

->addMethodConfig(SepaDirectDebit::class, $cofDisabledConfig)

->addMethodConfig(Paypal::class, $cofDisabledConfig);

$paypage->setPaymentMethodsConfigs($config);

$unzer->createPaypage($paypage);

Unzer unzer = new Unzer("s-priv-xxxxxxxxxx");

PaypageV2 paypage = new PaypageV2(new BigDecimal("9.99"), "EUR");

PaymentMethodConfig cofDisabledConfig = new PaymentMethodConfig(true)

.setCredentialOnFile(false);

HashMap<String, PaymentMethodConfig> configs = new HashMap<>();

configs.put("cards", cofDisabledConfig);

configs.put("sepaDirectDebit", cofDisabledConfig);

configs.put("paypal", cofDisabledConfig);

paypage.setPaymentMethodsConfigs(configs)

PaypageV2 response = unzer.createPaypage(paypage);

Step 3: Forward the customer to the Hosted Payment Page

After you initialized the Hosted Payment Page resource, implement the following flow:

- Forward the customer to the

redirectUrlreturned in the response to your initialization request. - The customer is forwarded to the Hosted Payment Page.

- After a successful payment or abort on the Hosted Payment Page, the customer is redirected to the payment status dependant returnUrl specified in the initialization call in step 2.

Step 4: Check payment statusserver side

Once the payment is done, the customer will be redirected back to returnURL, that you set in Step 1. Now you can fetch the payment and check its status. Check all possible payment states here.

There are a few ways the payment can be verified after the return URL is called:

- Via a GET call and the

paypageIdhere, which returns paymentId and transaction status. - Via a GET call and the

paymentIdhere, which returns paypageId and payment details. - Via Webhook: Subscribe to the payment webhook and receive the

paymentId.

- Don’t forget to verify that the

paymentIdthat you receive in thereturnUrlbelongs to thepaypageId. - For security reasons, we recommend that you always check that the payment ID that you received in the return URL matches the paypage ID. This is because of the risk when the browsers allow their users to manipulate any query parameters.

Get payments via Paypage ID

This endpoint can be called after the payment page is finished and the customer has returned to the shop.

It will contain the paymentId, status and information about failures. For LinkPay with multiuse, this endpoint will contain all payments.

The current status of the payment can be seen in the response.

GET https://paypage.unzer.com/v2/merchant/paypage/{paypageId}

{

"payments": [

{

"paymentId": "s-pay-1",

"transactionStatus": "success",

"creationDate": "2024-08-22T14:42:57.944Z",

"messages": [

{

"code": "string",

"customer": "string",

"merchant": "string"

}

]

}

],

"total": 0

}

Get Payment via Payment ID

This endpoint can be called after the payment page is finished and the customer has returned to the shop with the paymentId parameter passed in the URL.

Keep in mind to verify that the paymentId received in the returnUrl belongs to the paypageId.

GET https://api.unzer.com/v1/payments/{paymentId}

{

"id": "s-pay-131937",

"state": {

"id": 1,

"name": "completed"

},

"amount": {

"total": "20.0000",

"charged": "20.0000",

"canceled": "0.0000",

"remaining": "0.0000"

},

"currency": "EUR",

"orderId": "",

"invoiceId": "",

"resources": {

"customerId": "",

"paymentId": "s-pay-131937",

"basketId": "",

"metadataId": "",

"payPageId": "12345",

"traceId": "70ddf3152a798c554d9751a6d77812ae",

"typeId": "s-eps-grpucjmy5zrk"

},

"transactions": [

{

"date": "2021-05-10 00:51:03",

"type": "charge",

"status": "success",

"url": "https://api.unzer.com/v1/payments/s-pay-131937/charges/s-chg-1",

"amount": "20.0000"

}

]

}

Step 5: Display payment resultclient side

After the transaction is made you should display its result to the customer in the front end using the information from previous step.

Keep in mind that depending on the payment method used, information relevant for the customer as a part of the success/error message can differ. For example, for Unzer Invoice and Unzer Prepayment you should display payment details to the customer.

Notifications

NotificationsWe recommend subscribing to the payment event to receive notifications about any changes to the payment resource. As soon as the event is triggered you should fetch the payment and update the order status in your shop according to its status.

{

"event":"payment.pending",

"publicKey":"s-pub-xxxxxxxxxx",

"retrieveUrl":"https://api.unzer.com/v1/payments/s-pay-774",

"paymentId":"s-pay-774"

}

For more details on implementing webhooks to receive notifications, see Notifications page.

Localization

We support localization with locale option parameters. Please check the Localization page on supported locales.

To localize your page, pass a locale parameter to the redirectUrl. When the locale value is set to auto, the language of the customer’s browser is read, and if supported by Unzer, your page is translated to this language. If you pass another language value, this language is always selected, regardless of the browser’s language.

var redirectUrl = returnData.redirectUrl

// Setting the page to always load in German language

redirectUrl += '&locale=de-DE'

// redirect the customer to customized Hosted Payment Page

window.location.href = redirectUrl

Customization

The following customization options are available for the Hosted Payment Page:

- style.fontFamily

- style.buttonColor

- style.primaryTextColor

- style.linkColor

- style.backgroundColor

- style.cornerRadius

- style.shadows

- style.hideUnzerLogo

- logoImage

- shopName

Customize the images

You can customize the logo of the Payment Page by passing the parameter logoImage

POST https://paypage.unzer.com/v2/merchant/paypage

{

...

"logoImage": "https://logo-image-url",

...

}

// ...

$paypage->setLogoImage('https://logo-image-url');

// ...

...

paypage.setLogoImage('https://logo-image-url');

...

Customize the basket item images

You can set individual basket images that show on the Payment Page. Check the Basket resource documentation page for details: Manage basket (direct API calls), Manage basket (PHP SDK), Manage basket (Java SDK).

{

"totalValueGross": "84.9000",

"currencyCode": "EUR",

"orderId": "",

"basketItems": [ {

"basketItemReferenceId": "item-1",

"quantity": "2",

"vat": "0E-7",

"amountDiscountPerUnitGross": "0.0000",

"amountPerUnitGross": "20.0000",

"title": "Hoodie",

"unit": "Pc.",

"subTitle": "Clothes",

"type": "goods",

"imageUrl": "https://static.unzer.com/assets/images/baskets/ZippHoodie_Unzer.jpg"

},

{

"basketItemReferenceId": "item-2",

"quantity": "6",

"vat": "0E-7",

"amountDiscountPerUnitGross": "0.0000",

"amountPerUnitGross": "5.0000",

"title": "Writing Pad",

"unit": "Pc.",

"subTitle": "Office Supplies",

"type": "goods",

"imageUrl": "https://static.unzer.com/assets/images/baskets/WritingPad.jpg"

},

{

"basketItemReferenceId": "item-6",

"quantity": "10",

"vat": "0E-7",

"amountDiscountPerUnitGross": "0.0000",

"amountPerUnitGross": "1.9900",

"title": "Screws",

"unit": "Pc.",

"subTitle": "hardened aluminium",

"type": "goods",

"imageUrl": "https://static.unzer.com/assets/images/baskets/WritingPad.jpg"

},

{

"title": "10 EUR voucher newsletter registration",

"basketItemReferenceId": "item-3",

"quantity": 1,

"amountPerUnitGross": 0.00,

"amountDiscountPerUnitGross": 10.00,

"vat": 1,

"type": "voucher"

},

{

"title": "Shipment costs",

"basketItemReferenceId": "item-4",

"quantity": 1,

"amountPerUnitGross": 5.00,

"vat": 1,

"subTitle": "Insured standard shipment",

"type": "shipment"

}]

}

Manage payment

After you have made a transaction, you can perform additional operations on it. A common example is the cancel operation which can be done for most of the payment methods.

Cancel before money receipt (reversal)

To reduce or cancel a reservation on the customer account, perform a cancel on the initial transaction. An example of reversal would be unblocking the reserved amount on a customer account after they returned a rented car.

POST https://api.unzer.com/v1/payments/s-pay-1/authorize/cancels

{

"amount" : "100.00"

}

$unzer = new Unzer('s-priv-xxxxxxxxxx');

$payment = $unzer->fetchPayment('s-pay-1');

$unzer->cancelAuthorizationByPayment($payment, 100.00);

Unzer unzer = new Unzer("s-priv-xxxxxxxxxx");

Authorization authorization = unzer.fetchAuthorization('s-pay-1');

Cancel cancel = authorization.cancel();

The response looks similar to the following example:

{

"id": "s-cnl-1",

"isSuccess": true,

"isPending": false,

"isError": false,

"card3ds": false,

"message": {

"code": "COR.000.100.112",

"merchant": "Request successfully processed in 'Merchant in Connector Test Mode'",

"customer": "Your payments have been successfully processed in sandbox mode."

},

"amount": "100.0000",

"currency": "EUR",

"date": "2021-06-10 10:47:43",

"resources": {

"customerId": "",

"paymentId": "s-pay-1",

"basketId": "",

"metadataId": "",

"payPageId": "",

"traceId": "d9763d2fdd7830bdd73f76957423f351",

"typeId": "s-crd-e6f2yo8ggwhg"

},

"paymentReference": "",

"processing": {

"uniqueId": "31HA07BC8174FCB9564077FB19AEF03B",

"shortId": "4872.4846.3345",

"traceId": "d9763d2fdd7830bdd73f76957423f351"

}

}

Cancel after money receipt (refund)

To refund a payment you need to perform a cancel on a successful charge transaction. This transfers the money back to the customer.

POST https://api.unzer.com/v1/payments/s-pay-1/charges/s-chg-1/cancels

{

"amount" : "12.450",

"paymentReference": "Test cancel transaction"

}

$unzer = new Unzer('s-priv-xxxxxxxxxx');

$charge = $unzer->fetchChargeById('s-pay-1', 's-chg-1');

$cancel = $charge->cancel();

Unzer unzer = new Unzer("s-priv-xxxxxxxxxx");

Cancel cancel = unzer.cancelCharge("s-pay-1", "s-chg-1");

Error handling

Error handlingAll requests to the API can result in an error that should be handled. Refer to the Error handling guide to learn more about Unzer API (and other) errors and handling them.

Test & go live

Test & go liveYou should always test your integration before going live. First perform test transactions using test data. Next, check against Integration checklist and Go-live checklist to make sure the integration is complete and you’re ready to go live.

See also

- Payment page demo

- Supported payment methods

- Manage API resources: Direct API integration, PHP SDK integration, Java SDK integration